One of the biggest mistakes investors make is "investing in the rearview mirror." Unlike other "clearance sale" opportunities, when our asset values go down, we often freeze or, worse, sell when prices are the lowest. By the time we get our courage up, half the cyclical bargains have vanished!

Cutting your losses can be a rational response to an individual stock or bond draw-down when it is indicative of management problems. But it is the opposite of what we should do when holding diversified funds of asset classes that are integral to the economy. When a broad-based asset class/fund is down, it is almost always a buying opportunity.

2022 is the latest case in point. As you can see from the scatter chart in my recent Blog post, "How Stock/Bond Portfolios Have Performed Over Time, "2022 was spectacularly unprecedented. Bonds and stocks plummeted together, which has only happened once since 1969 and then only by a fraction.

So what to do when stocks and bonds perform so badly in one calendar year?

BUY! Of course. But what to buy? In 2023, one could say, "Buy anything!" because every type of asset went down in 2022, with very few exceptions. Assuming you are investing in whole asset classes (e.g. stocks, bonds, dividend stocks, tech stocks, infrastructure stocks...), which are broadly diversified and integral to the economy, the safest thing to buy is perhaps the one that is down the most relative to its history. In 2022, that asset class was bonds.

Bonds are Back!

The extreme downswing in valuations in 2022 now represents a buying opportunity to invest in bond funds with much-reduced risk! One might hesitate to be shifting funds toward bonds, which have performed poorly relative to stocks for a long time. But that would be investing in the rearview mirror again. For this reason, I added a Bond Fund to the Rigden Financial Model Portfolio at the end of 2022. This fund went down 13.22% in 2022. I predict it will make that back and more, with good annual returns in the years ahead. Why? Because the economy is already teetering in the face of higher interest rates. Bond interest yields are higher now, and bond resale values get a boost from falling rates, which have just begun to decline.

So this is a time to make sure you have bond funds in your portfolio, preferably within a registered account (RRSP, RRIF, or TFSA), to shelter you from the higher taxable interest income bonds are generating!

Interest Sensitive Stocks

The other asset class that suffered the most from rate hikes was tech stocks. The tech fund in the Rigden Model Portfolio went down 29.51% in 2022. Tech stocks are sensitive to interest rates because so much of their value is based on future earnings projections. Higher interest rates discount the value of future earnings. But falling interest rates make the promise of future earnings growth more valuable. Our tech fund is already responding to the more benign interest rate outlook. It is up 20.1% YTD on May 3, 2023.

Can one really keep up with it all?

The simple answer is no. Even those who succeed temporarily become overconfident, speculative, and eventually flummoxed by market values that go from extreme to more extreme before reversing. Not only are asset class valuations cyclical there is also the question of what time frame to respond to. And to what degree? The Bond fund I added was already down a historically unusual 4.39% in 2021 (Bond funds rarely go down that much, even in a bad year). Should we have rebalanced to buy more bonds, then? Yes! Even though bonds were down again sharply in 2022, you could not have predicted it, and they were down much less than most classes of stocks.

How to Make Good Portfolio Management Happen

There are too many variables that affect asset prices to varying degrees at any given time. Some are short-term, and others are long-lived. The solution I have arrived at has been to diversify and slightly over-weight undeniable long-term trends (see the "No Idea" investment philosophy behind the Rigden model portfolio).

The best ways to invest in uncertain times (which is all the time, by the way) and capture the contrarian opportunities that cyclical asset prices constantly present is to:

Automate your asset allocation through an asset allocation fund, which automatically rebalances itself to the asset allocation (stocks vs. bonds) that is right for you. This means transferring some of the gains from higher-performing assets to the cyclical underperforming ones - automatically selling high and buying low.

Using a model portfolio approach to accomplish the same thing with periodic, usually annual, rebalancing. But this requires regular meetings and plucking up the courage to do it, which is not something to take for granted.

A third dimension I love is the employment of segregated funds, which guarantee 75 to 100% of your initial investment or more via resets to your beneficiaries. As Benjamin Franklin said, "Nothing is certain, but death and taxes." Knowing that no losses will flow through to your estate is a silver lining when your funds are down and a good feeling all the time.

Life Insurance as an investment. There has been a lot of talk about "Private Equity" as an asset class in recent years. Private equity usually means participating in ownership of small portfolios of real estate, mortgages, and many other things much smaller than publicly traded companies. "Participating" life insurance is a way that small investors can participate in this market, albeit more efficiently and with professional management, by sharing in the fortunes of a big insurance company portfolio. The dividend yield has been around 6% per year, which compounds tax-free for one's estate. But the cash value of such policies can be drawn upon in a variety of ways or borrowed against as needed for retirement income. There are other tax management strategies for life insurance as an investment, especially so for business owners.

Where will the next long-term trend come from?

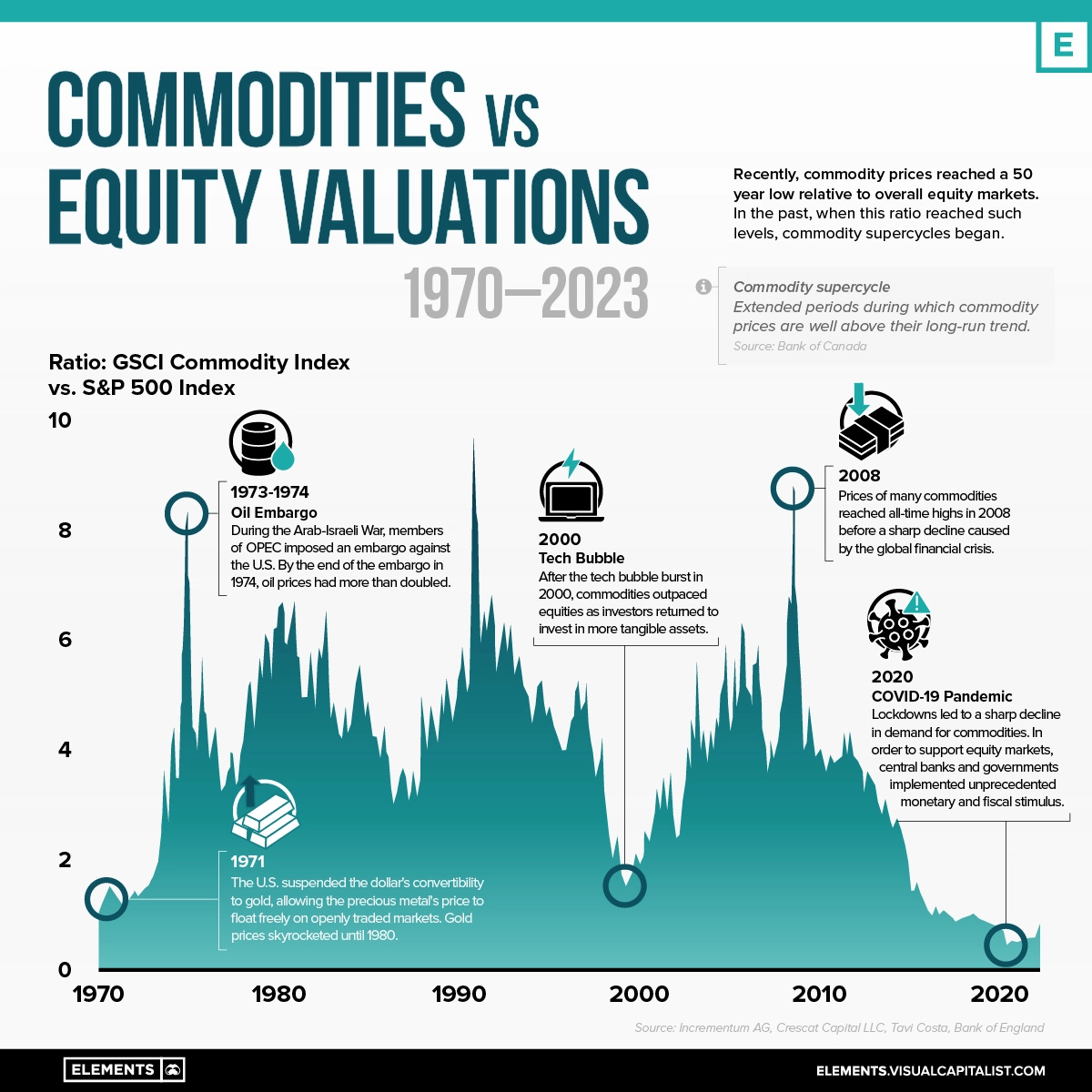

Commodity producers like Canada might be due for a cyclical bounce soon. Have a look at the chart of commodities vs. equity valuations below. I also added a Canadian Dividend asset allocation fund to the model portfolio in December because this trend would indicate that Canadian stocks and bonds are increasingly well-positioned for the years to come, which, of course, contradicts the rearview.

I hope you have found my ruminations here interesting and that you will subscribe to my blog and share them if you do. Please click on my appointment link below, and let's talk soon!

Layth Matthews